Sharp multidirectional changes in bunker prices will continue, according to Sergey Ivanov, director at Marine Bunker Exchange (MABUX), who does not expect any drastic changes in the global bunker market’s trends until the conflict in Ukraine is resolved.

Meanwhile, high volatility remains in the global bunker market, accompanied by sharp irregular changes in bunker indices, according to MABUX’s latest report.

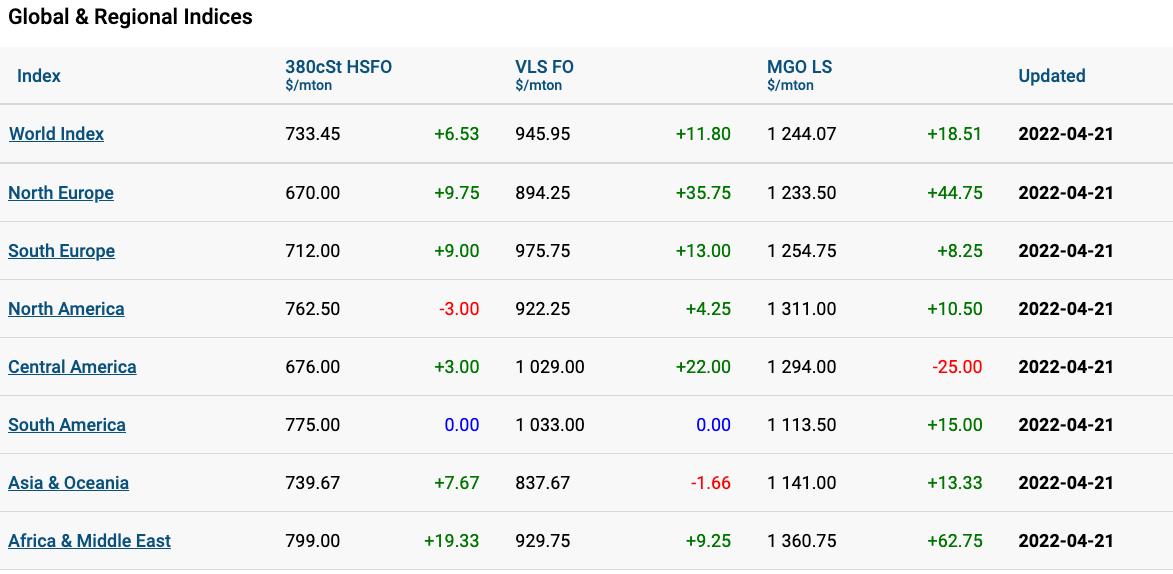

Over Week 16, MABUX Bunker Index switched again to a firm upward evolution with the 380 HSFO Index rising to US$728.95/mt, the VLSFO Index increasing to US$934.58/mt and the MGO Index showing the most significant growth – by US$50.30 – to US$1,224.12/mt.

“This is the result of a sharp decline in Russian oil products’ supplies in the global bunker market,” said Ivanov.

Additionally, the Global Scrubber Spread (SS) weekly average – the price difference between 380 HSFO and VLSFO – continued its moderate decline in a week – US$$3.41.

In Rotterdam, the average value of SS Spread, on the contrary, rose slightly to US$220.83. Meantime, the 380 HSFO/VLSFO price difference at the Port of Singapore continues to shrink sharply, with the average down another US$23.83 to US$123.50 and in absolute value the SS Spread has dropped to US$112 as of 20 April.

As per the International Energy Agency’s (IEA) estimation, the global demand for natural gas is set to “decline slightly” this year as a result of higher prices and market disruptions caused by Russia’s invasion of Ukraine.

The IEA had previously forecast a 1% growth in its quarterly update published in January. The new downward revision to the forecast amounts to 50 billion cubic metres (cbm), the equivalent of about half of last year’s US LNG exports.

According to the MABUX report, the IEA noted that average spot LNG prices in Asia during the 2021-22 heating season were more than four times their five-year average. In Europe, spot LNG prices were five times their five-year average, in spite of a mild winter. The IEA also noted that Russia has been Europe’s largest natural gas supplier, meeting 33% of the region’s demand in 2021, up from 25% in 2009.

The IEA forecast that natural gas consumption in Europe will fall by close to 6%. In Asia, however, natural gas consumption is expected to grow by 3% in 2022, and the Americas, Africa and the Middle East are expected to be affected less directly by gas market volatility, as they principally rely on domestic gas production.

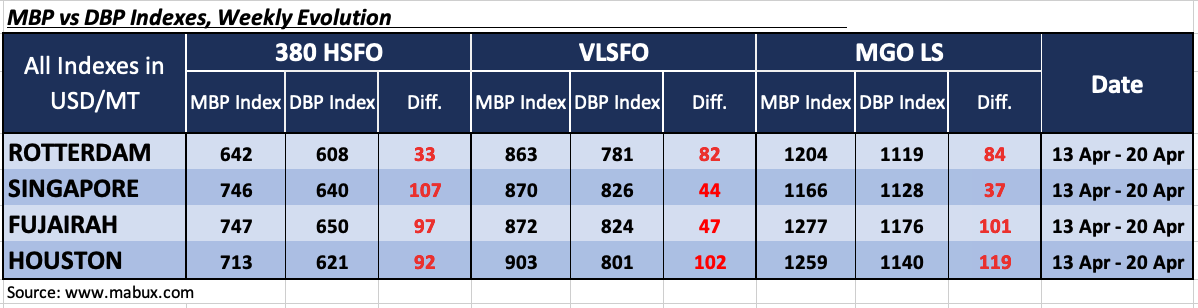

Over Week 16, the average correlation of MABUX MBP Index (market bunker prices) vs MABUX DBP Index (MABUX digital bunker benchmark) did not change significantly with all major bunker fuels being in the zone of significant overpricing in all selected ports.

The 380 HSFO fuel’s overcharge margins at the end of the week were registered as: in Rotterdam – plus US$33, in Singapore – plus US$107, in Fujairah – plus US$97 and in Houston – plus US$92. In the 380 HSFO segment, MABUX MBP/DBP Index did not have any firm trend and changed irregularly, according to Ivanov.

VLSFO fuel grade, according to MABUX MBP/DBP Index, was also overpriced in all selected ports: plus US$82 in Rotterdam, plus US$44 in Singapore, plus US$47 in Fujairah and plus US$102 in Houston. “The overcharge ratio in the VLSFO segment declined slightly,” pointed out Ivanov.

As for MGO LS, the MABUX MBP/DBP Index also registered an overpricing of this type of fuel over the week in all four selected ports: Rotterdam – plus US$84, Singapore – plus US$37, Fujairah – plus US$101 and Houston – plus US$119. “Here, MABUX MBP/DBP Index also did not have a firm dynamics and changed irregularly,” said Ivanov.